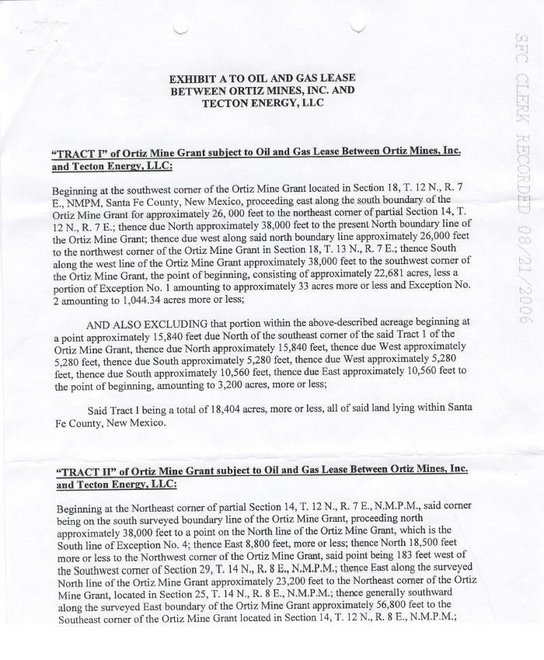

For example, can a non-profit receive mineral interests to lease for oil and gas "wildcatting"? The question would be found in the gift planning guide of the nonprofit. An example of a gift planning guide as it relates to oil, gas, and mineral interests can be found at Gift Planners.com (Appendix A, #6, pdf p. 19)

"6. Oil, Gas, and Mineral Interests: The Charity may accept oil and gas property interests, when appropriate. Prior to acceptance of an oil and gas interest the gift shall be approved by the Gift Acceptance Committee, and if necessary, by the Foundation’s legal counsel. Criteria for acceptance of the property shall include:

- Gifts of surface rights should have a value of $20,000 or greater.

- Gifts of oil, gas and mineral interests should generate at least $3,000 per year in royalties or other income (as determined by the average of the three years prior to the gift).

- The property should not have extended liabilities or other considerations that make receipt of the gift inappropriate

- A working interest is rarely accepted. A working interest may only be accepted where when there is a plan to minimize potential liability and tax consequences.

- The property should undergo an environmental review to ensure that the Charity has no current or potential exposure to environmental liability."

What if SFO were to sell the mineral property to the surface owner(s) over the subsurface property? The Opera could probably sell them for the same $150,000 that the SFO was paid by J Bar Cane, as reported by Staci Matlock in today's New Mexican.

About CSF, what became of the restrictive funds? Where did the money go and how was it spent?

Was the old CSF dissolved or bought?

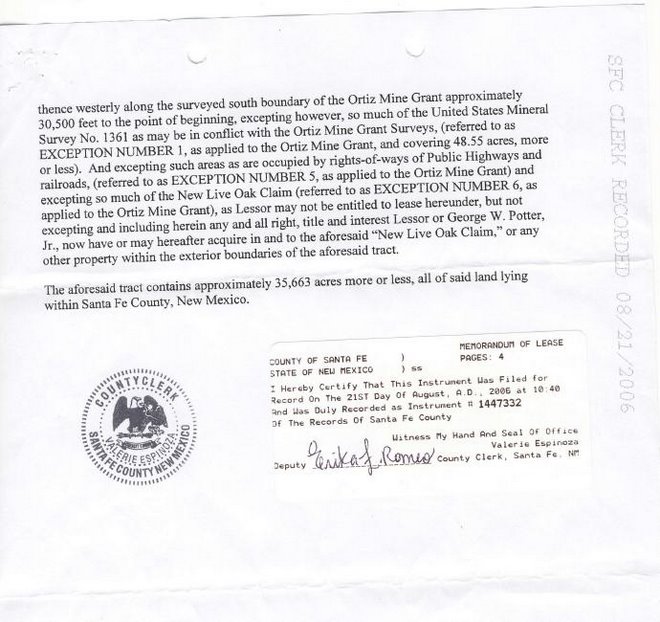

Evidently Laureate Education operates CSF, but where are the old CSF assets? What about the endowments of a separate foundation operated by a for-profit? According to a Journal North article, "Debra Epstein, spokesperson for the Laureate, said the mineral rights have stayed with the old College of Santa Fe and could not be transferred to a for-profit organization like Laureate."

And what of the situation with the City of Santa Fe? Does the city own any of these mineral interests?

Using Gift Planners.com (Appendix A, pdf p. 1) as guide, "(t)he primary benefit of gift acceptance policies is to maintain discipline in gift acceptance and administration. Discipline prevents the acceptance of gifts that will cost the nonprofit organization time, money, and possibly its reputation, by reminding the organization when to say, "No."'

As this situation unfolds, there seems to be more and more questions.

No comments:

Post a Comment