According to Standard & Poor's, "Master Limited Partnerships (MLPs) are limited partnerships that are publicly traded on a U.S. securities exchange. The limited partnership structure results in favorable tax treatment by avoiding the corporate income tax. MLPs as an asset class originated in the 1980s through laws passed by Congress designed to encourage investment in energy and natural resources. Early partnerships that took advantage of these laws had mixed results. Many partnerships were taking advantage of tax avoidance to extend their scopes beyond those originally envisioned. In response to this, Congress strengthened regulations to ensure that an MLP must generate at least 90% of its income from qualified sources, most of which pertain to natural resources. As a result, the majority of MLPs in existence today operate in the energy infrastructure industry, although recent issues have included companies operating in a variety of different industries. This asset class has grown rapidly in recent years, with the number of listed energy MLPs roughly tripling since 2000."

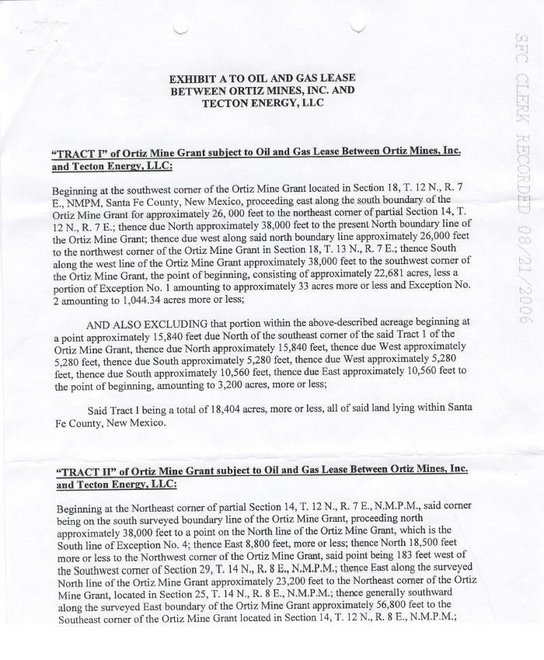

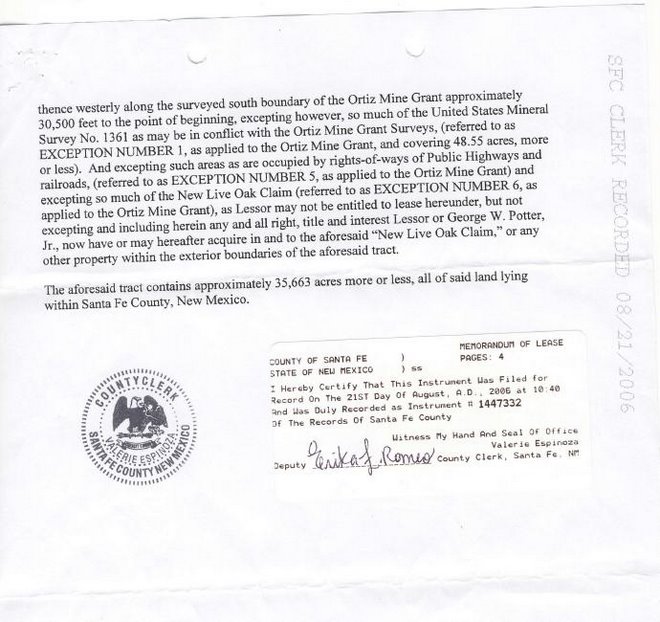

Lehman Brothers sponsored the Quantum Energy Partners 2007 MLP Investors Conference. Tecton Energy, LLC is a portfolio company of Quantum. Bill Dirks, Co-Founder and Managing Partner, Tecton Energy, LLC, co-moderated the 2nd Annual Oil & Gas Acquistion & Divestiture Conference and MLP Symposium in November of 2007. Tecton has targeted the Galisto Basin for natural gas and oil exploration. Since Tecton is a private company, there is no public disclosure of its financing.

As the current financial crisis unfolds, a situation the former Federal Reserve Chairman Alan Greenspan described as a "once in a half century, probably once in a century type of event," what will be the ramifications to Wall Street firms and speculative investments? From New Mexico through the Rocky Mountain region, from Texas to Arkansas up to Pennsylvania and to New York, unconventional oil & gas extraction plays have created a drilling boom. Such speculation needs financing.

However, according to Bloomberg TV, "Treasury Secretary Henry Paulson says the nation's credit markets are very fragile and still frozen." He urges the U.S. Congress to pass his $700 billion proposal to avert a financial meltdown. Taxpayers have already bailed out AIG with a $85 billion loan in exchange for 80% of the insurer's stock, making the federal government the majority stockholder of an insurance company.

As the market adjusts to these events, the appetite for risk will be quelled. As liquidity dries up, investment firms will deleverage. Will there be a financial melt down? We do not know. What we do know is that profits are privatized and losses are socialized. Many say that the reason for the financial crisis is deregulation. And to address our energy problems, the oil & gas industry clamors "drill, baby, drill" and whines for more deregulation.

Hey you Anonymous moron:

ReplyDeleteWhat facts need to be "strait"? Why don't you "git yer phacts strait" and tell us what the hell you're talking about before you spout off or is that you the only way you morons know how to respond?

I think this is a terrible blog and you are wasting your time.

ReplyDelete